NFT Collectibles Primer 2021, Part 1: The 3 Types of NFT Every Collector Needs to Know

And Why Less Than 1% of NFT Projects Today Are Likely to Survive

The NFT Collective Community

Why do we humans (and magpies) have this innate desire to collect things? From comic books and action figures as kids, to sports cars and luxury watches as adults, building up a collection of rare items is a favorite pastime for many. Likely beginning during our formative years with trading card games like Pokémon or toys like Funko Pops, these habits and interests have stuck with us and become part of our identities today.

Now, we could be analytical and theorize that our ancestors accumulated during times of abundance and survived through scarcity thanks to collecting, and eventually, these traits got passed down to us. I suppose this makes sense for money and food, but less-so for collecting non-essentials like fine art.

Climbing up Maslow’s Hierarchy of Needs 🤓 (don’t worry, I’ll keep this brief), some well-to-dos might include rare collectables as an important part of a diversified investment portfolio (safety, security). Others will argue its all about ego and status (esteem). Personally, I think many of us get a sense of connection to a community when we collect (belongingness), but without overthinking things and killing the spirit of this article 😅, let’s just agree that it’s just an enjoyable part of the human experience.

Cultural values change over time. Whereas older generations cherished physical assets (precious metals, real-estate, sports cards, vintage wine, etc., which have more-or-less held value over time), Millennials and Gen-Z are growing up in a digital age where virtual real-estate and in-game character skins are valuable too. New industries and asset classes have emerged, and most recently with cryptocurrencies and NFTs, we now have natively digital assets that can be created, exchanged, and valued using familiar metrics.

Are crypto and NFTs the new frontier of the creator-driven economy, or is it all just a fad doomed to fail in the long-run? 👉 Read on to find out, as we dig deeper into the three NFT niches every collector out there needs to know!

The 3 NFT Collectibles Markets to Keep on Your Radar:

3. Licensed Brands and Existing IPs 🤩

This niche is probably the easiest for people of all ages to grasp: Describing NFTs as digital versions of sports cards, stickers, action figures, etc. immediately clicks for many people even if they’ve never touched crypto or NFTs before. We all have friends in that position, so please do them and me a favor by sharing this article!

Before blockchain innovation came about, digital versions of such items were, for all intents and purposes, worthless - they could all be replicated infinitely (i.e. saving a jpeg and sending to to infinite users), and/or any scarcity they held was contrived (i.e. “limited-edition” Fortnite skins). Check out The Value of Assets on the Blockchain section of The Beginner’s Guide to NFTs, Part 1 to understand more.

The great thing about NFTs based on IPs (intellectual properties), is that it’s not starting from scratch. We don’t have to look far to find a fandom and know that there is a community interested in something. With an existing audience, it’s easier for existing brands to adopt NFTs and transition to Web3, the inevitable next phase of the internet.

IP holders, NFTs unlock entirely new and creative ways to engage with their fans and monetize via direct distribution and ownership models. If set up correctly with a clear value proposition, both brands and audiences can equitably share in the success of the franchise, and isn’t that how it should be?

Important note:

Much of what we cover in this section states that owners of branded NFTs only own the digital copy (personal-use, non-commercial rights); they do not own the moment, footage, or rights to reproduce the content, which is completely in-line with traditional sports cards and other licensed collectibles (see the NBA Top Shot terms and conditions for reference). That said, such restrictions haven’t stopped physical and digital collectibles from fetching high valuations on secondary markets.

Sports

Arguably the most successful project to date is NBA Top Shot by Dapper Labs. From humble beginnings with Cryptokitties on Etheruem in 2017, the start-up has grown into a “unicorn,” even building blockchain network focused on NFTs: Flow. Selling officially licensed “moments” of NBA history has brought the company huge success, but imho, it is still a very basic, albeit very well executed, way for brands to utilize NFTs.

If you’re into sports, you might also want to check out:

Sorare, a licensed (European) football collectible.

Candy, a licensed Major League Baseball NFT project coming fall 2021.

DraftKings (sports gambling platform) for their upcoming NFT marketplace, which will be the exclusive home of Tom Brady’s NFTs.

FanZone.io, a (European) football digital trading card product (sign up and your first pack is free).

nWayPlay, official partner of the Olympic games for licensed NFT merch.

Media and Entertainment

Media and entertainment studios with a library of IPs may have found massive new merchandising and licensing potential with NFTs. Just in the first half of 2021, we’ve already seen many large names in media including Time and CNN get on the bandwagon, with many more following suit:

Nifty’s, an NFT social media marketplace platform which recently partnered with Warner Bros Studio on the release of “Space Jam, A New Legacy.” Early users scored free Looney Tunes NFTs.

SuperRare isn’t just for crypto-artists. Today, you’ll be able to find familiar names like Playboy feature NFTs as well 💋

VeVe is an NFT collectibles marketplace and mobile app that has partnered with many recognizable titles including Adventure Time, Tokidoki, DC Comics, and Star Trek. Until recently, they had only been available to users of a fairly obscure blockchain network called “Ecomi,” but have since partnered with ImmutableX, a secure layer-2 scaling solution built on Ethereum.

TerraVirtua is an AR/VR-centric NFT collectibles platform that has partnered with film franchises such as The Godfather, Pacific Rim, and Godzilla.

Curio is a “highly curated digital collectibles and experiences” platform that features digital trading cards, art drops, reward systems, and “exclusive experiences” (i.e. live events between fans and creators). It has announced partnerships with Fremantle (American Gods), Dark Horse Comics, and Universal Pictures.

Blockchain Creative Labs, an upcoming NFT studio by Fox Entertainment, has already announced upcoming partnerships with Bento Box Animation and Rick and Morty creator, Dan Harmon.

Celebrity Brands

Very much brands themselves, celebrities and influencers have also embraced NFTs, sometimes even un non-cringe ways. 😅

Crypto.com’s NFT platform offers curated collectibles from notable celebrities and artists, including Snoop Dogg, Lionel Richie, and Boy George.

Nifty Gateway, one of the OGs in the NFT space and pioneers of the whole concept of “NFT Drops” (limited edition NFT events), has partnered with celebrities such as Paris Hilton, Eminem, and Grimes.

Genies, an LA-based NFT avatar and wearables app on the Flow blockchain (same one as NBA Top Shot), recently raised $65 million to build out their platform. They have already announced partnerships with the likes of Rihanna, Shawn Mendes, and Cardi B!

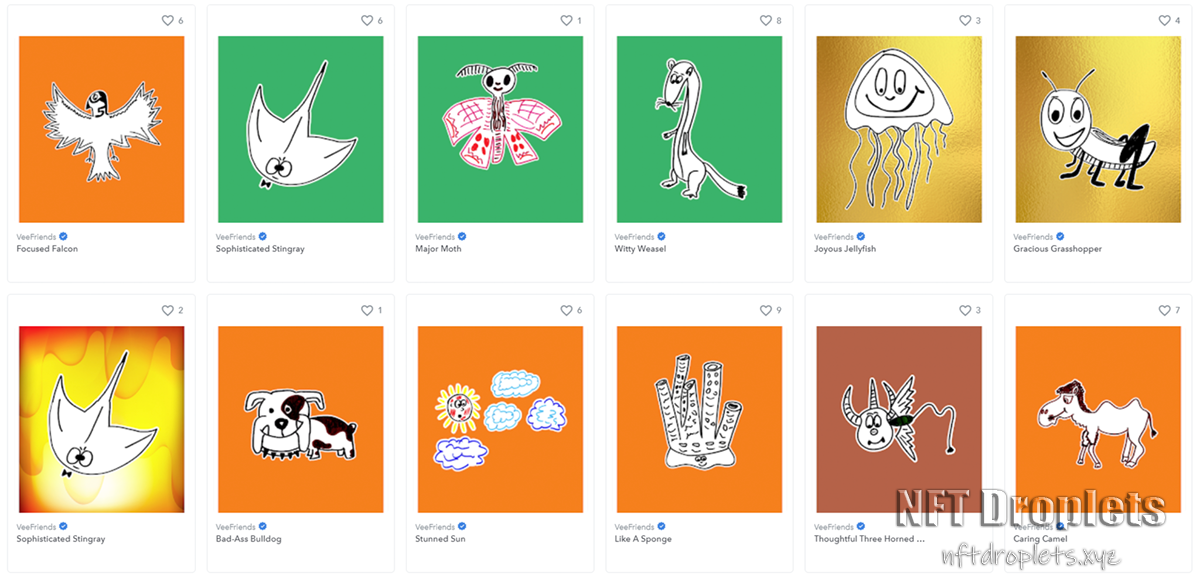

On the influencer side, internet entrepreneur Gary Vaynerchuk, a.k.a. GaryVee, the outspoken chairman of VaynerX Media, launched an experimental NFT IP project (built by Nameless on Ethereum) called VeeFriends. Love or hate his persona, Gary’s charismatic delivery and his ability to call early trends in media and marketing can’t be denied. What makes VeeFriends interesting are the various perks that each NFT has. So far, we’ve seen NFTs provide holders with event access, physical gift subscriptions, and personal experiences with Gary and his team (such use-cases will soon replace apps like Cameo and their 25% platform fee, imho).

In addition to various value incentives for fans, holders of these NFTs benefit from the inherent qualities of NFTs themselves. They truly own their purchases, and can use and exchange them as they please, free of lockup periods, censorship (i.e. risk of cancellation from the issuer), and reliance on an intermediary exchange like Ticketmaster. Fans of Gary Vee will also almost certainly value their NFTs as collectibles even after any utility they had is consumed.

Overall, I think that VeeFriends succeeded in building an innovative influencer-fan engagement model using NFTs, and I hope to see more projects utilize the programmability of NFTs to add beyond scarce jpegs moving forward. VaynerX also recently launched VaynerNFT, an NFT marketing service company, so it appears this won’t be Gary’s last NFT project.

Internet-Native Fandoms

The internet is a breeding ground for new culture and communities to form, where ideas can go viral in a matter of hours. Many dismiss internet memes as a lowbrow and simplistic way to share ideas, but some (myself included) see them holding a special place in the history and culture of the internet itself.

It was just a matter of time until the original creators of viral memes took advantage of the hot NFT market. Mashable has a list of memes that have sold as NFTs, featuring such historic classics as “Doge,” “Nyan Cat” and “Overly Attached Girlfriend.”

There are also crypto-native IPs, which I’m still having trouble categorizing since they’re not based on existing brands. The selling point for most of these projects is the unique utility they offer. Platforms like Kolektiv, Ether.cards (which boasts real-world utilities such as product discounts), Charged Particles (which has a passive income component), and (Don't Buy) Meme (which are earned by staking tokens on the platform) partner with contract artists to create limited edition digital trading card collections. There are also Marble Cards, which essentially “wrap” every website on the internet into a unique NFT trading card (and has collected many cease and desist orders along the way 😂). Interesting products, to say the least.

Finally, some web brands have started testing out NFTs, most notably Twitter's inaugural NFT collection, Reddit’s CryptoSnoos (platform mascot) NFT platform built on Arbitrum (a layer-2 scaling solution on Ethereum), and most recently, Shopify announced that merchants will soon be able to sell NFTs directly through their platform. Social media and big tech companies doing NFT drops is one thing, but when they start supporting NFTs directly in the user experience, we will be truly be entering a new phase of the internet (Web3 and the Metaverse). It’s just a matter of time until more social media platforms like Instagram, Discord, and Twitch do something with NFTs. 👀

2. Video Games 🎮

Like established brands in other forms of entertainment, video games with an audience of active players should find NFT adoption to be a natural fit.

The video game industry is a massive market, and I have a couple articles planned coming up which will be delving deeper into the NFT components of gaming and concepts of the Metaverse, but for the purposes of this article, we’ll just be focusing on the space from a collector’s perspective.

Sports Games

The sports game genre seems underrepresented in NFT games so far, but I expect it to grow along with the rest of the sector as licensing hurdles with NFTs get addressed. The only notable projects at this time are the Sorare for its fantasy football league gameplay, and Zed Run, a digital horse racing play-to-earn game.

Trading Card Games

For those of us grew up with tabletop trading card games like Pokémon and Magic the Gathering, the concept of TCGs as NFTs is an easy concept to grasp. Since its cardboard beginnings, the TCG genre has exploded and has transcended the physical to become an online genre as well.

The online TCG leaders are without a doubt Hearthstone, from Blizzard Entertainment, and MTG Online, from Wizards of the Coast. At first, I was surprised we haven’t seen more TCGs launch as NFT projects yet, given the natural fit NFTs bring to both the development and collectability perspective. However, it’s hard to generate a sustainable player-base from scratch, especially for TCGs, and the incumbents like Blizzard probably don’t feel pressured to open up their marketplaces to decentralized blockchains (yet).

The top NFT TCG in the space is Gods Unchained, which has similar gameplay to MTG Online. It was created by Immutable, one of the leaders in NFT game development, and the creators of ImmutableX, a layer-2 scaling solution for Ethereum. After years of focusing on building out their platform, the Immutable team recently released their $GODS token and has really been ramping up their marketing strategy. The news releases seem to keep flowing so definitely keep Gods Unchained and future project on ImmutableX on your radar.

Action-Adventure/ Role-Playing Games

Every player account, character, NPC, item, weapon, piece of clothing, crafting resource, land plot, achievement badge; basically anything unique in-game that a player can own will be an NFT. Games like RuneScape and World of Warcraft defined MMOs as a genre, and the players in this space are some of the most loyal and committed in the industry.

In the crypto space however, this genre is still currently quite minuscule. Given that it’s mostly made up of indie studios (no AAA game studios yet, but this will change), coupled with the ambitious scale and development times that are typically required, this should come as no surprise. Ember Sword, Guild of Guardians, and Illuvium are all upcoming titles in the genre getting a lot of attention, and they have all featured and/or will feature NFT pre-sales this year. Given the success of similar games outside of NFTs, as a collector/gamer, it might be a good idea to keep all three of these projects on your radar.

Virtual Pets

Remember the 2017 Cryptokitties craze? It was basically a cat-version of Tamagochis on the blockchain in which users could interact with their NFT critters in various ways, such as grooming them, feeding them, breeding them, and playing with them. Though somewhat of a stretch to call it a game, the collectible cat tokens were the beginnings for what would become NFTs today!

In the last couple months, one such project has not only become the leader in the NFT gaming sector, but in many metrics including total active users, sales volume, and revenue, has become one of the top dApps in the entire crypto space! Enter: Axie Infinity.

What started off as a Pokémon-like 3-on-3 play-to-earn battle game has become one of the biggest crypto success stories of all time. There are also the uplifting stories coming from developing nations with limited employment opportunities, like the Philippines and Argentina, where players have been able to generate a living income for themselves and their families.

A team of three Axies are required to play, so you can understand why they’d be in demand. If you’re interested in experiencing the fun for yourself, check out these introductory articles that cover the world of Axie Infinity and basic setup and gameplay.

An additional project of note is Aavegotchi, a virtual pet game built on one of the top DeFi (decentralized finance) platform in the space, AAVE. Aavegotchi uses NFTs to essentially gamify saving and investing, and continues to build out what users can do with their little ghost tokens. 👻 If I had to describe it, it’s like if your savings account was a virtual pet that changes form depending on your balance and interest rate (definitely one of the most creative NFT/DeFi projects I’ve seen). This article on Non-Fungible.com really explains it well.

Metaverse Games

What is the Metaverse, you might ask? The form the Metaverse will take is still unknowable at this point, but in the words, Matthew Ball, of one of the most prolific thinkers on Metaverses today:

“(The Metaverse) is typically portrayed as a sort of digital 'jacked-in' internet – a manifestation of actual reality, but one based in a virtual (often theme park-like) world...Just as it was hard to envision in 1982 what the Internet of 2020 would be — and harder still to communicate it to those who had never even 'logged' onto it at that time — we don’t really know how to describe the Metaverse.”

-Matthew Ball, Venture Capitalist and Blogger

Today, the decentralized Metaverse platforms typically refer to the virtual land dApps: Decentraland, Cryptovoxels, The Sandbox, and Somnium Space. In these virtual worlds, the top NFT assets you’ll come across are likely virtual land plots and wearables, which users need to build on and to look stylish, respectively.

Axie Inifinity, Aavegochi, and Ember Sword also have virtual land as NFTs, but they are still too early in development and intent to be included as Metaverse assets at this time.

While game NFTs are currently second on the list, I fully expect it to take the first slot in the coming years. Like many, I see video games as being a familiar way for people to understand NFTs, to the point that they will on-board the greatest number users in the future.

1. Crypto-Art 🖼

2021 has been a breakout year for NFTs, and most of the mainstream focus has been on crypto-art (predominantly digital works tokenized as NFTs on Ethereum, although we’re seeing growing adoption on other blockchains too). Note that for this article, we’ll be focusing on graphical art. If you’re interested in audio NFTs (and the innovation we’re seeing in content distribution, royalty structures, revenue sharing, and copyrights), please check out my previous article on music and NFTs: 🎵

Blue-Chip Crypto-Art

Though most blockchains (like Ethereum) are permission-less and let any artist mint their artwork as an NFT, we have seen that as in the physical world of art, curation adds organization and value to the art market. Several NFT platforms like SuperRare and KnownOrigin screen artists before allowing them access, and has given rise to what some call, “Blue-Chip” crypto-art.

The most publicized sale of curated crypto-art to date is probably Beeple’s “The First 5000 Days,” which was sold by Christie’s Auction House for $69,3 million. Since then, we’ve seen digital artists finally get the institutional recognition they deserve, with established auction houses like Christie’s and Sotheby’s feature works from the likes of Pak, Fewocious, XCOPY, and Fvckrender.

We’re also seeing more famous gallery artist names adopting NFTs as a way to distribute their work and build their community. For example, Damien Hirst recently created his Genesis drop project, “The Currency,” organized by international art service facility, Heni, in collaboration with Palm NFT Studio. Hell, even Justin Roiland, co-creator of Rick and Morty, auctioned his painting, “mypeoplefriend” with Sotheby’s this year.

Amateur/Undiscovered/Upcoming Crypto-Art

Everyone is a passionate artist at heart with a unique message to express. Many artists work day jobs but still create art purely for the love of the process, independent of profession and/or income. However, we’re already seeing many artists using NFTs to grow their audiences, and in some cases, even generating enough income to sustain themselves by their art alone (i.e. Beeple and Fvckrender were relative unknowns until these past couple years).

You’ll find many pieces on non-curated, permission-less NFT marketplaces on the Ethereum blockchain like OpenSea and Foundation, but the market leader in the crypto-art community for the moment is Hic-Et-Nunc (abbreviated: HEN) on the Tezos blockchain, a low energy consumption and low cost network that fits with the ethics of the art community (#cleannft).

For collectors looking for a quick profit, this is the highest risk area of crypto-art - it is highly illiquid and the chances of picking out what pieces will explode from of an infinite sea of artists is like buying a lottery ticket. That said, for the collector who wants to support their favorite artists and build a collection of NFTs that they love, this can be a treasure trove.

Generative Crypto-Art

This year, huge interest and appreciation has emerged in the crypto-art market for art generated through code. The technical elegance and randomized beauty of generative art, coupled with key characteristics of NFTs (scarcity, unique RNG, and on-chain data), has become a watershed moment in establishing generative art as a standalone vertical in art history.

Generative art is interesting, not only for its visual appeal, but because each unique piece of a collection is produced using the same code! The variation is inherent to whatever data the artist decides to use (commonly, the contract address, owner’s address, and/or token indexes used as inputs), and there’s no telling how it will affect the final piece sometimes (a huge part of the fun during art drops). Further, since large files are rarely needed, these types of NFTs tend to be viewed as more durable - the visuals can be generated on-demand by executing the code with no danger of media going offline.

ArtBlocks.io is the most popular curated platform in the on-chain generative art space, and has launched several sought-after projects including Dimitri Cherniak's Ringers and Tyler Hobbs' Fidenza (I think this one is particularly cool, and evidently, so do a lot of other people). When an artist drops their piece on ArtBlocks (typically for 0.1 ETH each), each NFT is minted when the buyer purchases it.

For collectors, the appeal lies in the variety of pieces available in a single collection. Art is essentially game-ified - some pieces from the same collection are much more sought after because of their randomly generated traits (we’ll cover some tools in Part 2 that will help make sense of this concept).

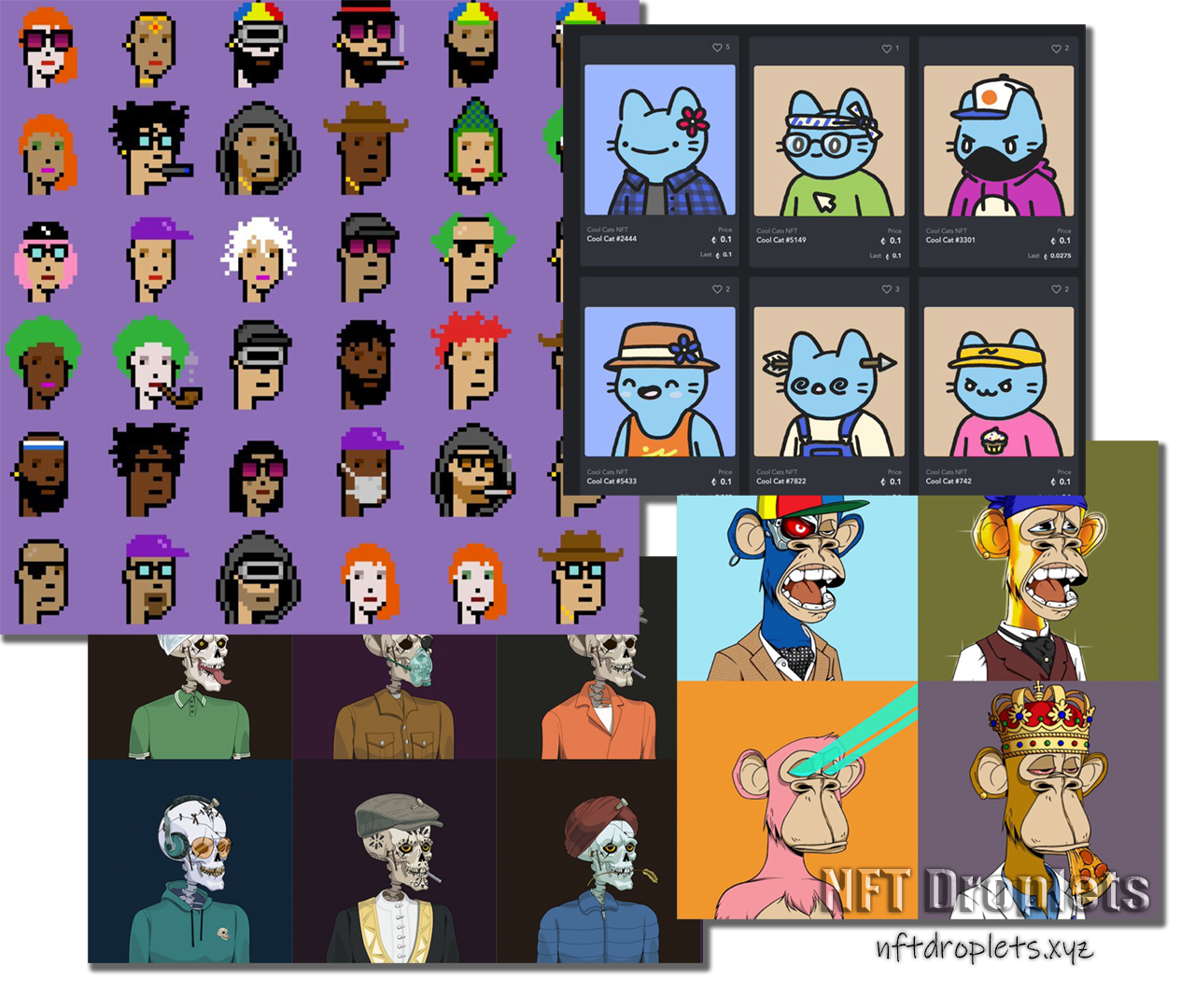

Avatar NFTs (Status/Sub-Culture Collectibles)

Art is subjective, so some might not consider avatars, a.k.a. “PFPs” (profile-pics) to be considered art. However, the fact is that this is probably one of the most active areas in the NFT space today (though branded NFTs and Axie Infinity are definitely up there too), and one that collectors should keep near the top of their list.

Starting in earnest in 2021, the popularity of unique avatar NFT projects has gone through the roof. For the most part holders of these NFTs treat these types of projects as online status symbols.

Most of these projects seem to follow a standard template:

~10,000 unique NFTs, typically depicting a variation of a character, composed of various traits (i.e. gender, color, accessories, etc.) combined in different ways. Think: digital Mr. Potato Heads.

They are typically 2d images that owners use as profile pics on social media accounts (though anyone could use the same pic, it’d be like someone uploading a pic of someone else’s Porsche in their Instagram flex reel 🤷♂️).

While all NFTs are unique, some will be more coveted than others thanks to the traits/combination of traits they hold. For example, of the 10,000 total CryptoPunks, there are 6039 male human punks, but only nine alien punks (the most expensive punk sale to date was Christie’s action for #7523, a.k.a "The Covid Alien"). That said, there can be cases where less rare traits are more valued, maybe because they resonate with the community more than another, scarcer trait (i.e. CryptoPunks with hoodies are cooler than those with rarer chokers, and get a higher premium).

An online community of enthusiasts, where in some cases, owning an NFT from a given project is a requirement for entry. What constitutes a “community” is sometimes subjective, and apart from a select handful of projects like CryptoPunks, most of the new projects will need to prove their worth for years to come (a Twitter following and a Discord server is enough for some to “invest” in tokenized jpegs, but as we’ll cover in Part 2, project loyalty can be a fickle thing in crypto).

When success and mainstream attention hits one project (CryptoPunks), the copycats come flooding in. While some actually bring some creativity to the space and seem to have organic communities, many just take a cookie-cutter template approach and feel like a cash-grab.

In no particular order, examples of avatar projects include CryptoPunks, Avastars, Hashmasks, BAYC/BAKC, Wicked Craniums, Dead Heads (this one actually looks interesting because the team behind it is looking to create an animated series based on it), Cool Cats, AstroFrens (full disclosure, I own a Fren) …the list is endless. In the current environment, projects can go from vogue to forgotten in a matter of days (just a week or two ago, SDB, BOTB, and My F*cking Pickle (…🤨) were all the rage; today, they see just a fraction of the interest they once had).

That said, just as interest can leave a hyped project, it can just as unpredictably return (perhaps through a combination of healthy community growth and a resurgence in speculation). One such high-profile project this year that went under the radar after some initial hype was Meetbits from Larva Labs: one of the most influential teams in the NFT space to date.

Team Spotlight: Larva Labs

From humble beginnings as a duo of software developers, Matt Hall and John Watkinson created Larva Labs, an indie mobile app company that also experimented on the blockchain. The two remain the only members of the Larva Labs team to this day.

What started off as an experiment in 2017 by two Canadians on Reddit giving away pixelated heads to anyone willing to pay the transaction fees has become a culturally, historically, and financially significant asset in just a few short years! As you might have guessed, that project was CryptoPunks.

CryptoPunks is credited as being the “OG” avatar project (before people even started using NFTs in their profile pics), and helped form the basis of the entire non-fungible token standard (ERC-721) that we use on Ethereum today! Flash forward four years and we can see how mainstream the Punks have gone: In July 2021, Gary Vaynerchuk revealed that he owns 52 Punks and 54 Meebits and Jay-Z now owns a Punk (and an ENS domain: officialjayz.eth)!

For an in-depth writeup on the history of the CryptoPunks project, be sure to check out TechCrunch’s “The Cult of CryptoPunks” article.At the time CryptoPunks was released, the entire crypto market was in a bear market 📉, but that didn’t stop Matt and John to continue to experiment with and build NFTs. Their next notable project was a venture into generative art called “Autoglyphs,” which is widely credited as being the first example of on-chain generative art. A generative algorithm capable of producing billions of unique ascii visuals was used only once to mint a collection of just 512 NFTs.

“Meebits,” the latest NFT project released by Larva Labs, is a collection of 20,000 unique 3d characters for use in AR/VR, with the vision of being used as avatars in virtual worlds like Decentraland (think 3d CryptoPunks). When the project dropped, existing CryptoPunk and Autoglyph owners were able to claim a free Meebit; the rest were auctioned off. Though the hype around the project subdued in the weeks following its release, it has recently seen a resurgence of interest.

Larva Labs has proven that creative experimentation and commitment can materialize in unimaginable ways. These guys obviously love what they do, and their contributions to the entire crypto space are sure to go down in history.

So what makes one project “art” and one project a “collectible?” IMHO, it all comes down to narrative: what story/message is the artist trying to convey, and what is the purpose of the piece itself? Good art makes us question our preconceived views on life; collectibles tend to cater more towards our interests, emotional needs, and sense of identity. In the same sentence though, art is collectible, and collectibles can be art. However we rationalize it, narratives drive our decisions, so ask yourself these sorts of questions before making any decision to buy or sell.

Coming Up in Part 2…

Whew! That was a lot of material to cover, but hopefully as a collector, you found something that resonated and helped you to get a clearer picture of the crazy NFT markets.

Understanding your options is one thing, but navigating the infinite number of NFT projects out there is another. In the next part, we’ll go over the essential things to look for in any project, and the best tools available to give you an edge. See you soon!

As always, thank you so much for taking time to share this journey together with me into the world of NFTs. I hope you found the content helpful, and maybe even fun to read! 😁

If you would like to help support the NFT Droplets newsletter, please do Share this article with someone who would find it helpful.

If you’re not yet subscribed to NFT Droplets, enter your email below and be among the first to find out when fresh NFT articles get dropped (I promise that you will never get spammed, nor will your email ever be shared with anyone). ✅👇

If you have any questions, comments, or suggestions for future articles, please share your thoughts in the comments section below. 💬

⚠ Disclaimer ⚠

Cryptocurrencies and NFTs are a speculative asset class. Be aware of the risks involved and know that you could lose money. Everything I share references an opinion and is for information and entertainment purposes only. It is not intended to be investment advice. Please consult a licensed professional before making any investment decision.