The Beginner's Guide to NFTs, Part 3 - Gas-Powered Crypto-Wallets

Connecting to Ethereum, Safely and Easily (Updated August 2021)

Updated on August 2021 for Ethereum's “London Hard Fork” & “EIP-1559”It’s Time to Take Ownership!

First off, I truly hope that the preceding articles helped give you a bit more understanding (and a lot more confidence) about what you’re about to get into. After reading up on all that theory, I’m sure you’re pumped and ready to get hands-on: to create, buy, sell, and build for yourself; to manifest the numerous ideas I’m sure are already filling your mind. 💭

And now the moment we’ve all been waiting for: let’s set up your wallet! 🥳

Your Keys to the Kingdom 🏰

You might remember some terms introduced back in Part 2 like recovery seed and private keys, that we didn’t really examine. Now that we’re about to set up your crypto-wallet, let’s understand what these key 🔑 terms mean.

Secret Recovery Phrase

Also known as a seed phrase, recovery seed, mnemonic phrase or recovery phrase, this is a list of randomly generated words, typically 12, 18, or 24 words in length. We won’t get into entire science behind how a private key is created from recovery seed (much of which is way beyond this humble writer’s brain anyways), so just remember this:

A secret recovery phrase is tied to a (very large) piece of binary (computer-readable) data called a master seed, and that, in turn, is used to create multiple private keys.

👉 The correct order and spelling of all words in a recovery seed are crucial, so check, double-check, and check again to make sure the backup copy you print out or write down is correct!

Private Key

Private keys are generated from a single secret recovery phrase, and are required to approve any and all transactions on digital assets owned inside a wallet. Private keys are stored in your wallet on your behalf and prove ownership of your assets. With that said, I hope it’s clear how important it is to not share your private keys or access to your wallet with anyone! 🚨

Public Keys & Public Addresses

Each private key has a cryptographically linked public key. Only the public key can be derived from a private key; it is impossible to go the other way around to trace the private key from a public key. Once generated, a public key is then hashed (mapped to a fixed size piece of data) to generate a public address, which can be safely shared publicly, when you purchase NFTs, for example.

The breakthrough with public-private key cryptographic security is that anyone (or rather, any dApp or blockchain node) can mathematically prove that a specific public-private key pair was used in a valid transaction -all without giving away the identity of the private key itself. In other words, a truth can be verified objectively, without trust in an intermediary. 😵

TL;DR 👇

Never reveal your secret recovery phrase or private keys to anyone, and keep your recovery seed written down and stored in a secure location.

Ensure that the only information you share about your wallet(s) are your public addresses, which you will need to do to perform transactions..

Setting Up Your Wallet

There are an overwhelming number of wallet options out there, and with the speed at which new features and technologies are rolled out in crypto, it’s easy not to know where to start. We’ll cover a few available options, but our focus will be mainly on one or two, as I don’t expect us to need to go much further, at least, for now. Before you decide, ask yourself some questions like:

“How and where do I plan to access my wallet? At home on my desktop or on the go on my mobile device? Both?”

“How often do I need to make transactions?”

“How much value do I plan to store?”

The higher the value, the more you’ll want to invest in security. 🔐

Of course, your answers today will probably change down the line, as will the best wallets available for your needs, so be sure to subscribe if you haven’t already so you don’t get caught off-guard by future updates. ✅👇

With over a million monthly active users (and growing), let’s start with the first (and possibly even the only) wallet you’ll need: MetaMask - a wallet that you’ll use right from your internet browser!

Web Browser Wallets: The Most Popular Option 💻

Meet MetaMask 🦊, a web extension that connects you to the vast ecosystem of Ethereum and Web3, all from the comfort of your favorite browser. Brave, Google Chrome, Microsoft Edge, and Mozilla Firefox are all supported (if you don’t use any of those, I’m actually curious as to what you use 🧐).

I’m biased towards Brave 🦁, by the way. If you haven't used it before, it feels very much like Chrome with all the same extensions, but it lets me control my data (you do you though!)MetaMask only supports the Ethereum blockchain, so be sure to only send ETH and Ethereum-based tokens to your MetaMask public address(es).

Let’s review step-by-step process to get set up:

Visit the MetaMask Downloads page.

Install the web extension for you browser of choice (in my case, Brave).

Once installed, a new window/tab should open.

Click the Get Started button.On the next page, click the Create a Wallet button and agree to the terms and conditions on the next page (which you’ll notice are much less lengthy and invasive than what you might be used to from similar agreements).

Create a (good) password, check the box (acknowledging that you have read and agree to the Terms of Use), and click the Create button. Note that your MetaMask password is not your private key - it is a convenient (but secure) way for you to sign into MetaMask so you don’t have to enter your private key(s) every time you use your wallet on your current device. Your password allows MetaMask to use your private key on your behalf when authorized to do so, which it encrypts and stores securely with your browser data.

This is the most critical step…I cannot stress this enough! 👇

Upon setting your password, you will be given the option to access your secret recovery phrase. Ignore the tempting options to Copy to clipboard or Save as CSV file. Don’t highlight the text to copy it either. Don’t even take a screenshot or a picture on your phone, as all of these could compromise your data. Instead, get a pen and paper and write down (clearly, in order) every word you see. 📝Congratulations! Not only have you created a MetaMask account, but you are also now the proud owner of a paper wallet, which you can use to unlock your crypto-wallet on any device. That said, let's finish setting up MetaMask.With MetaMask in your browser, you now have access to the Web3 decentralized web (how cool is that?)! When you visit a dApp website, you’ll be prompted to connect via your MetaMask wallet. To do so, you’ll need to sign the request (grant your wallet permission using your private key). In other words, to prove that you are the owner of the wallet address.

Make sure you’re connected to Ethereum Mainnet (unless you intentionally choose to connect to a different network in the future).

You’ll need to re-enter the same password you used to create the account on your device to sign into MetaMask, but your private keys are stored encrypted in your browser data - not ideal, but not insecure. If you need to copy down your recovery seed again, click the top-right colored circle and then click Settings.

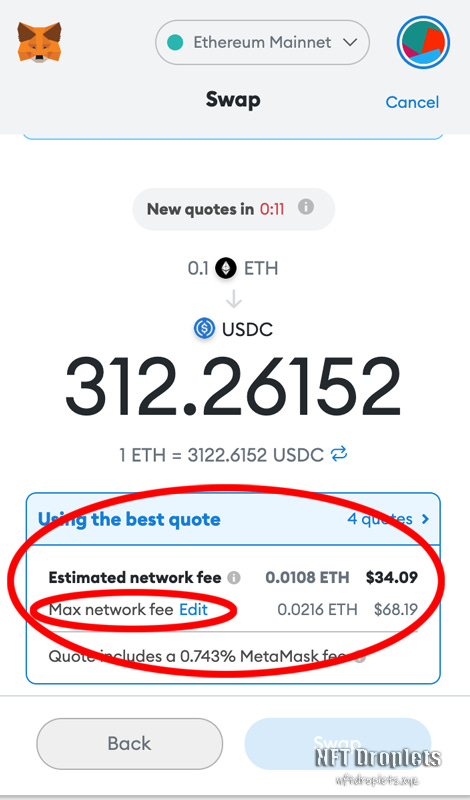

MetaMask also has a built in peer-to-peer Swap feature (aggregator service) that allows users to swap between different tokens on Ethereum. Be aware of possible slippage (under Advanced Options) and an additional 0.3% - 0.875% service fee that MetaMask charges for using this service.

Consider setting up multiple accounts in your MetaMask. Doing so not only helps to organize your allocations (i.e. one for trading, one for holding certain tokens, etc.), but because the private keys and recovery seed cannot be traced, your public addresses cannot be associated to each other, which helps keep your activities private and secure.

Metamask is made by Consensys, one of the most reputable companies in the crypto space. Their tools are used by the majority of developers on Ethereum. In fact, it was founded by Joseph Lubin, one of the founding members of Ethereum itself! 😲Coming Soon: Brave Wallet

The Brave browser released a roadmap of their upcoming version (2.0) in early 2021. Among several promising new features is a native non-custodial wallet (for both desktop and mobile versions) and built in decentralized token exchange (much like MetaMask, but without the need to install an extension). You can read about the Brave 2.0 roadmap here.

Mobile Wallets: Convenience and Mobility 📱

Mobile dApp wallets are also a popular, convenient option. There is a mobile version of MetaMask, and though it’s still a little clunky, the experience is getting closer to the desktop version with every update. Some wallets (such as Enjin, a wallet that specializes in NFT game assets) feature native dApp browsers, which mean users don’t need to install an extension to connect to Web3 services.

Wallet Connect

Wallet Connect is a convenient, secure way to connect your mobile wallet to a dApp (usually on your desktop) via a QR code. It requires no additional installation and is supported by several dApps (including NFT marketplaces like Open Sea) and mobile wallets (i.e. Trust (acquired by Binance in 2018), Argent (more on this one shortly), and MetaMask (mobile version)). It’s definitely worth trying out if you plan to use a mobile wallet that supports it.

Hardware Wallets: Maximum Security in the Palm of Your Hand 🛡

These are hands-down, the most secure non-custodial way to manage one’s digital assets. If you hold significant amounts of crypto, consider investing in one of the popular hardware wallet options out there, such as Ledger, Trezor, or Lattice.

Paper Wallets: Cheap & Unhackable (but not that waterproof) 📜

Be sure to always have at least one (hand-written) paper copy of your recovery seed(s) for all your wallets. You created one when you wrote down your MetaMask recovery seed (consider laminating and storing it in a secret, secure place, just in case).

Brain Wallets: Unbeatable Security, but How Good is Your Memory? 🧠

I have to include this option as the ultimate safeguard, particularly to those who hold significant portions of their net worth in digital assets. Memorizing 12-24 seed phrase words in proper order may be worth the effort in the slightest chance of a worst-case scenario…

Recovery Seedless Alternatives 🚫🌱

In reality, many people have enough to worry about and are already used to traditional online and banking models. If you really don’t want to use recovery seed, you’re in luck. Although I still believe non-custodial wallets are best, I admit they’re not for everyone - especially when the stress of having one starts to impact daily life. Thankfully, mainstream options that are much friendlier to consumers are already available:

For individuals, the Argent wallet is a very popular non-custodial mobile wallet alternative to the traditional model. Although it is targeted towards financial applications, it is able to store most NFTs. Instead of burdening users with a recovery seed, users are issued a free, human-readable ENS address, and account recovery is secured by the user’s own personal network (a.k.a. “guardians”). You can read more about their novel approach to the non-custodial wallet experience in this blog post. Note that because this wallet is actually a smart contract on the Ethereum network, there is a small one-time fee required to activate a new account.

For dApps and users, Portis and Fortimatic are two services whose mission is to boost the user experience of wallets and dApps for mainstream users. On the surface, the Portis wallet switches the recovery seed with the more familiar username and password model (be warned: there is no way to recover a password if you forget it, so it is highly recommended to use a password manager). Users can sign in using these credentials cross-platform, while their private keys are securely managed for them under the hood.

For businesses and institutions, there will always be custodial options. Financial service companies such as Hex Trust and Circle offer strategies involving digital assets (including cryptocurrencies, and more recently, NFTs).

Mix & Match: The Best of All Worlds 🦸♂️

My recommendation? Start with MetaMask, as most do, then try out a mobile wallet and services like Wallet Connect. If you’re really hardcore, look into hardware wallets, challenge yourself to set up a brain wallet, but in all cases, always save paper wallet backups of your recovery seed(s) and private key(s) in secure locations (ideally in fragments).

Gas-Guzzling NFTs

⛽ Gas is the network fee, denominated in a fraction of ETH called “Gwei” (which equals 0.000000001 ETH, to be exact), that users pay to network nodes to include their transactions in newly minted blocks on the Ethereum network. Depending on the state of congestion on the network, prices can fluctuate based on demand for block-space. You will need to authorize requests in your wallet prior to any transactions, and it is at this stage that you will be given an estimate of the network fees you will incur (i.e. gas fees).

When the gas fees are too high, it is sometimes doesn’t make financial sense to transact (i.e. buying or selling an NFT when gas fees will cost more than the NFT itself). Will it be this way on Ethereum forever? Thankfully, things should improve incrementally in the months/years to come as progress towards Ethereum 2.0 continues (I will absolutely be covering developments on this and how it affects the NFT space in future articles).

August 2021 Update: “London Hard Fork” & “EIP-1559”

On August 5, 2021, ”EIP-1559” was introduced to replace the previous fee structure. The goal: to reduce gas price volatility and give users a more predictable fee structure, and to change how the fees were distributed to the network.

For a really good, easy-to-read understanding of what the update mean for users, check out MetaMask's page all about EIP-1559!

Before:

Fees were based on a traditional “first-price auction,” and all fees were sent to the miner node. There was also no guarantee that a transaction would even go through, and every block was the same size, regardless of how much/little it was utilized. Overpayment and stuck transactions (if outbid on gas fees, a transaction could sit idly in the “mempool”) led to an overall negative user experience, sometimes requiring the user to cancel or update pending transactions.

Additionally, rewarding miners with 100% of the fees meant that there was no network-wide value accrued, with possible selling pressure of Ether by miners choosing to sell.After:

Fees will be calculated using a new base fee and priority fee (a.k.a “tip” or “gas premium” to incentivize miners to include a transaction) model, and users will be able to set a max fee (a.k.a. “fee cap” - the total amount they’re willing to spend).

The base fee is set algorithmically based on demand, and is generally expected to make up 25%-75% of the total fee. This portion of fees that would have previously been scooped up by miners is instead “burned” 🔥 (sent to an inaccessible address; basically destroyed forever). Similar to when a company a buys back its own stock, this reduces the overall circulating supply of Ether, and offsets new Ether issued to the miner (the inflation rate of ETH). Theoretically, this gives existing Ether more value vs. under the old gas fee structure.

The priority fee and max fee are set by the user, and any unused gas fees are refunded! (max fee - base fee - tip = refund 🤑)

Block sizes will also adjust to fit more transactions during times of high demand (i.e. NFT drops), and contract during quieter times. This should also result in stuck transactions being significantly rarer.What it means for you:

Contrary to what some are saying, this update doesn’t directly solve high fees - it just gives us more accuracy (base fee) and control (max fee and tip) over what we’re willing to pay. The update is also completely backwards compatible with tokens deployed before this update, but transactions will still be done using the old model (gas fees will just use the max fee set) and miss out on features like stable base fee and refunds on overpayment.

You can view how much ETH is/has been burned in real-time here. Oh, and don’t be a deadbeat! Remember to tip your miner. 👍

Until Ethereum 2.0 is fully deployed, here are a few general tricks to help save on gas fees:

Check a service like ETH Gas Station to see the most up-to-date fees on the network before making any transaction.

There may be patterns for when the network is more and less congested depending on time and day. This site is useful for monitoring network demand on Ethereum.

Be mindful that the more complex the smart contract is, the the more gas it costs to execute.

Getting Your Wallet Funded 💲

There are countless exchanges online that help onboard users from around the world into crypto by exchanging their national currencies for cryptocurrencies. Popular ones that service clients globally include Binance, Coinbase, Crypto.com, Gemini, Kraken, Huobi, and Swissborg, just to name a few. Your region might have options that cater better to your situation, so it’s worth checking around. Once you’re registered and you’ve deposited some funds into your account, it’s simply a matter of purchasing some crypto and sending some ETH from your exchange account to your own wallet, such as MetaMask. Each exchange and wallet service should provide easy to follow documentation and support for this process, so we won’t go into further detail here (just be sure to check things like withdrawal fees and daily limits first).

MetaMask also offers options to purchase cryptocurrencies using a debit card using a service called Wyre, which I will not speak on since I haven’t yet tried myself yet (it looks good, but again, keep an eye on those transaction and gas fees).

You’re All Set!

Congratulations! With your crypto-wallet set up and funded, your recovery seed(s) secure, and most importantly, the foundational knowledge you now possess, you are fully equipped and capable of flourishing in the Web3 economy. This is where your journey truly begins, and where things really start to get fun and interesting. 😎

In the final part of this series, we’ll refocus our attention on what started us off in this series in the first place: NFTs, and explore the diverse marketplaces, commentators, and opportunities abundant in this emerging crypto ecosystem. 🚀

As always, thank you so much for taking time to share this journey together with me into the world of NFTs. I hope you found the content helpful, and maybe even fun to read! 😁

If you would like to help support the NFT Droplets newsletter, please do Share this article with someone who would find it helpful.

If you’re not yet subscribed to NFT Droplets, enter your email below and be among the first to find out when fresh NFT articles get dropped (I promise that you will never get spammed, nor will your email ever be shared with anyone). ✅👇

If you have any questions, comments, or suggestions for future articles, please share your thoughts in the comments section below. 💬

⚠ Disclaimer ⚠

Cryptocurrencies and NFTs are a speculative asset class. Be aware of the risks involved and know that you could lose money. Everything I share references an opinion and is for information and entertainment purposes only. It is not intended to be investment advice. Please consult a licensed professional before making any investment decision.