The Beginner's Guide to NFTs, Part 2 - Bridge to the Blockchain

Getting Started with Ethereum

Blockchain 101

Before we begin, I want to commend you on putting in the time to understand the crypto space before diving in. Though Part 2 gets a little dry at points, I highly encourage you to continue and stick with it before attempting the practical portions coming up in the next part of this series.

Trust me - a little time spent building a solid foundation now will be so worth it when you’re not struggling with basic concepts down the line. 🏃♀️💨

"Hard choices, easy life. Easy choices, hard life." 🙏

-Jerzy Gregorek (referenced in Tim Ferriss’ Ted Talk)

That said, now that I have your commitment, we have a lot of new stuff to cover, so let’s get started! 🚀

What is a Blockchain?

Unless you’ve been living under a rock (or more like a boulder), you’ve likely heard of Bitcoin. Don’t worry if you you don’t know much about its history or any technical details on how it works (most don’t, but that doesn’t stop them from throwing their hard-earned money into it). The point is that Bitcoin started the blockchain revolution, starting with a white-paper published in 2008 (very much a response to the Great Recession and the government bailouts of too-big-to-fail financial institutions at the time 💰)

For the first time in history, ledgers (like the books an accountant updates) of asset transactions (when something of value changes ownership) are shared and provable, which means that conflicts are all but eliminated (i.e. today, if I buy something online have get into a payment dispute with the seller, it’s my bank’s records vs. theirs).

A blockchain is made up of an ever-growing list of blocks (collections of transaction data, timestamps, and connections to previous blocks via unique data signatures) that are linked together through highly secure cryptographic proofs (consensus algorithms). 🔐

The technology itself is very (very!) complex, but the key takeaways are that blockchains are:

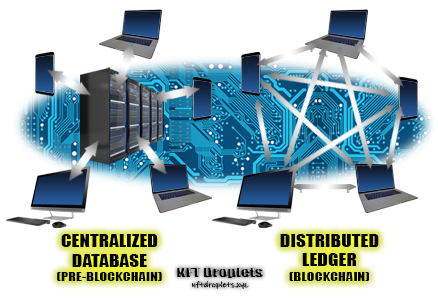

Distributed

Everyone has an identical version of the ledger that can’t be altered. This is called D.L.T., which stands for Distributed Ledger Technology.Replicated

Transactions are updated across the network, so everyone is using a verified, identical ledger at all times. By the way, any machine that actively participates in securing this ledger and validating blocks is called a node. 🖥

With the most options, tools, and practical applications available (with more added by the day), Ethereum was the first (and still the most widely-used) blockchain for NFTs (and much more), and is the obvious choice for us to use. However, things in crypto change fast, so it’s important to stay informed on recent developments. If another blockchain really takes the NFT world by storm, I will definitely be covering opportunities as they emerge, so be sure to subscribe for future updates if you haven’t done so already!

📝 Note: to keep things simple, please assume that whenever I use the term "blockchain" from hereon out, I am referring to public blockchains like Ethereum, which have open codebases and histories. There are also permissioned and private blockchains, which are mostly for internal enterprise use, but they are not the focus of these articles.Ethereum: The Smart Blockchain

Like the Bitcoin blockchain, Ethereum is a secure blockchain network used by a huge number of participants worldwide. Both are public and decentralized, which means that anyone can participate, and no one person or group can control the entire network (at least in theory; it hasn’t happened yet and gets less and less likely as more nodes join the network).

Unlike Bitcoin, Ethereum takes things beyond just updating a ledger of transactions - it also uses an breakthrough technology called smart contracts on its blockchain. We’ll revisit smart contracts in just a moment, but first, we need to cover another term on Ethereum that you’ll come across even more often. A little something called Ether.

Ether: The “Money” of Ethereum

Ether (commonly written as ETH), is used throughout the Ethereum ecosystem to “pay” the network for services we use (i.e. buying NFTs). Like Bitcoin, ETH is a fungible token.

A bit of ETH is created and issued programmatically to specialized nodes on the network called miners (nodes on the Ethereum network that complete to create new blocks), every time a new block is created on the blockchain. Whenever we perform a transaction on Ethereum, we pay a bit of ETH as a network fee - a portion of which is issued as an incentive to the miner that does the work to facilitate the transaction and create the block.

A fantastic property of Ether is how divisible it is. One ETH can be subdivided into fractional amounts (down to 18 decimal places). The smallest denomination of Ether is called a “Wei,” which is 0.000000000000000001 (1e-18) ETH. By comparison, Bitcoin is divisible to eight decimal places, and the dollar, well…, doesn’t come anywhere close to either.

The take-away is to know that you can hold less than a fraction of a penny’s worth of ETH. Also remember that you don’t need to own any Bitcoin to do anything on Ethereum; you just need a little bit of ETH!

Blockchain Building Blocks

This next part might get a bit technical, but even if some of what we cover doesn’t make sense right away, that’s okay! Just having a basic grasp of what these terms mean puts you ahead of most other users. As we begin to get more hands-on and put these ideas into practice, it will all start to make a lot more sense - I promise. 😉

Think of it this way: most users online (i.e. posting on social media, trading stocks, etc.) know how to work a website or an app without reading a single line of code, and yet they can still be total wizards (and so can you)! 🧙♂️

Smart Contracts

Smart contracts are computer code files that live on the blockchain. They allow any developer to create and share programs to the blockchain network, where they can then be used by any person, organization, or application that chooses to do so (including other smart contracts)! Because smart contracts are part of the blockchain, they are immutable, which means that once code is deployed to Ethereum, there’s no way to change it.* The code establishes a functional framework that executes automatically on the network when invoked (i.e. to query or make changes to the current owner of an NFT).

* Developers are actively finding ways to work within these limitations (EIP-2535), but it's a topic that goes far beyond the scope of this introductory article.DApps: Decentralized Applications

DApps are like the web apps that power the websites and mobile apps we know and use every day. What make dApps so revolutionary and set them apart from current (Web 2.0) technology? For now, let’s focus on two important features:

They decentralize the front end and back end using smart contracts

DApps retrieve data from and/or send data to at least one smart contract on the back end (server-side). On the front end (client-side), the user also also has a connection to the blockchain (authentication using their digital wallet - more on this shortly). For example, when you make transactions with your NFTs, any updates are made on-chain (on the blockchain ⛓) instead of off-chain (off the blockchain, perhaps…to a private database server that only a permissioned few can access 🕵️♂️).They operate on a peer-to-peer network

Though the goal for any dApp is to be decentralized as possible, the present reality is that we are in a transition phase - some components such as hosting and storage might be better off using centralized servers. However, the more decentralized components a dApp is built with, the more secure and reliable it theoretically is. For example, most apps are hosted on AWS/Google cloud servers - if they go down or block your account, you’re screwed. With a dApp built on decentralized storage networks, the application is hosted on a distributed, peer-to-peer network of people who volunteer their machines for the job (often incentivized by a token), so in theory, your dApp is always running and free from censorship. 🙊

All decentralized code in a dApp is also open and public, which increases transparency and makes it easier to spot suspicious code before damage can be done (as opposed to opaque enterprise applications that might be doing more than you think… 👀).

Whew! 😤

If your brain isn’t fried after reading all that, give yourself a pat on the back (and a quick break, if needed) - you earned it! 👍

We have one last but very important topic to cover in this article; one that consolidates almost everything we’ve covered thus far: wallets.

Wallets

A wallet is a special dApp that is used to store and manage digital assets on the blockchain. You’ll need a wallet to create and securely sign into accounts on NFT marketplaces, along with a world of other possibilities.

Wallets that support Ethereum don’t just work with ETH; they can be used to store and manage any compliant fungible and/or non-fungible token on the Ethereum blockchain! Many wallets also support assets on other blockchains, such is Bitcoin.

Wallets are secured by cryptographic technology that make them just about impossible to hack - any random attempt has less than 1 in 115 quattuorvigintillion chances of success. To put that into perspective, there are less atoms in the known universe!

Let’s start by looking at the two types of wallets you’ll encounter:

Custodial wallets and non-custodial wallets.

Custodial Wallets

For those of us who have dabbled a bit in crypto before, our first interaction with a wallet was on an online exchange website, and chances are, we didn’t even know it! That’s because a third-party (the company running the online exchange in this case) were the custodians of the wallet(s), which were likely not accessible to us through the website or app. The accounts we create with such services are more similar to our online bank or broker accounts.

When we use custodial wallets, we trust a third-party with the responsibility of securing and managing our assets on our behalf. In exchange for control and ownership, we get the convenience of fast transactions, a pretty user-interface, and customer support. Sure, it’s nice to only have to remember a password; to put the burden of responsibility on someone else, but when we use a custodial wallet, we are never truly in control of our assets. By the way, this also assumes that they actually have our assets in the first place. We are at the whim of the what the third-party allows us access to, which often results in high fees and limitations on what we can and can’t do with our assets. This hardly sounds like ownership to me!

In most cases, using a custodial wallet service is a necessary first step to exchange our local currency (dollars, euros, etc.) into cryptocurrencies. After that though, it should be our choice whether to keep our assets on the exchange (in a custodial wallet), or to transfer them to a non-custodial wallet that we are responsible for (I would not ever recommend using a service that does not give you the option to withdraw to your own wallet).

Non-Custodial Wallets

Also known as self-custodial wallets, these wallets make up the majority of options outside of online exchanges and give you much more control over your assets. Non-custodial wallets are extremely secure, and cannot do anything at any time without your explicit permission.

👉 Please note that moving forward, when I use the term wallet, I am referring to non-custodial wallets, not custodial wallets.Some wallets, known as “Web3 Wallets,” even come built-in with a Web 3.0 browser that enables you to connect your wallet to dApps on websites and interact with them! In fact, that’s exactly how we’ll be connecting to NFT marketplaces in the next parts of this series. There’s a good chance that you’ll be using this feature more and more as Web3 technology becomes more widely adopted by websites and platforms.

It’s important to remember that you can access your assets through any wallet dApp on any device, so long as you have your recovery seed. We’ll go over what that is in Part 3, but for now, just think of it as an ultra-secure password, but unlike most passwords that people reuse everywhere, this one’s uniquely generated, and subsequently, cannot be customized or reset. ❗☝

Unlike physical wallets, the assets inside a blockchain wallet aren’t actually inside the wallet; if something happens to your wallet dApp (i.e. your device dies or gets lost), you’ll be able to pick up where you left off with just your recovery seed. In some ways, wallets are kind of like on-demand portals to an alternate dimension of commerce✨… or something - only instead of a banker or notary public acting as a gatekeeper between you and your assets (and probably taking a healthy cut for themselves in the process), you are the final authority, as a proper owner should be. However, this can also be a double-edged sword, because it means that anyone who gets a hold of your recovery seed can also access your assets…

Of course, there’s always a middle-ground too. We’ll go over the spectrum of wallet options available in Part 3 so that you can make an informed decision as to which one(s) best suits your own needs. 👍

Do You Like Your Wallet 🥵 Hot or Cold 🥶 ?

Wallets are sometimes also referred to as being “hot” or “cold.”

While the terms custodial and non-custodial define ownership, hot and cold describe relationship, and as we will soon find out, each is designed to meet the needs of a specific purpose.

Hot Wallets 🔥

Hot wallets are dApps that connect directly to the internet.

They are convenient, but they are only as secure as the user’s online habits. If a user exposes themselves to malware, viruses, or is just ignorant about basic dos and don’ts online, there is a non-trivial chance that their hot wallet and the private data that it stores could become compromised. Hot wallets typically store a user’s credentials on the connected device itself (albeit in a highly secured fashion), and it is for this reason that it is typically recommended to only keep assets you plan to transact with regularly in a hot wallet. Almost all custodial wallets can be considered to be hot wallets (since you need to be online to connect to them), as well as non-custodial software wallets such as personal mobile apps.

Cold Wallets 🧊

By contrast, cold wallets never connect directly to the internet.

They are physical devices that store a user’s private keys (further security generated from a user’s recovery seed; more on this in Part 3), and can be as sophisticated as hardware wallets (small electronic devices made specifically to hold private keys), or as simple as paper wallets (literally a piece of paper that has the recovery seed written on it). 📝

When to Use Which?

For most casual users, as long as they practice good habits online, a hot wallet or two should be sufficient for their needs (exchanging local currency for crypto, buying and holding NFTs, etc.). However, those that both transact regularly and hold a portion of their assets for the long term may find themselves wanting to keep a significant amount of value in the crypto ecosystem. For these people, I recommend setting up both a hot wallet(s) (for online transactions) and a cold wallet(s) (for long term storage).

👉 As a general rule, treat a hot wallet is your checking account 💳, and a cold wallet is your savings account/vault 🔐.

Unblocked & Unchained

That was a lot of info, but hopefully we demystified a lot of the crypto-jargon you often hear, and you feel empowered by what you’ve learned so far. On blockchains like Ethereum, you and I attain sovereignty over our assets; our wealth; our freedom! ✊

In Part 3 of this series, we finish building our bridge to the blockchain.

When you’re ready, click the button below, because you are about to set up your own Ethereum wallet in just a few clicks! 👏

As always, thank you so much for taking time to share this journey together with me into the world of NFTs. I hope you found the content helpful, and maybe even fun to read! 😁

If you would like to help support the NFT Droplets newsletter, please do Share this article with someone who would find it helpful.

If you’re not yet subscribed to NFT Droplets, enter your email below and be among the first to find out when fresh NFT articles get dropped (I promise that you will never get spammed, nor will your email ever be shared with anyone). ✅👇

If you have any questions, comments, or suggestions for future articles, please share your thoughts in the comments section below. 💬

⚠ Disclaimer ⚠

Cryptocurrencies and NFTs are a speculative asset class. Be aware of the risks involved and know that you could lose money. Everything I share references an opinion and is for information and entertainment purposes only. It is not intended to be investment advice. Please consult a licensed professional before making any investment decision.